Va home loan pre approval calculator

If you want to protect yourself against rising interest rates and ensure that the loan terms you used to build your budget are locked you might consider locking in your rate with your lender when you fill out your loan application. Is providing the calculator tools above as a courtesy and.

Va Loan Funding Fee Closing Cost Calculator

Check out our affordability calculator and look for homebuyer grants in your area.

. For licensing information go to. April 22nd is Earth Day but you can make your home sustainable 247 365. It may be relatively small compared with mortgage payments and property taxes but insurance premiums add up over the length of a 30-year home loan.

An FHA Title I loan can be used for refinancing a manufactured home as well as purchasing one. Mortgage rates valid as of 31 Aug 2022 0919 am. Paying the upfront costs of buying a new home can be challenging.

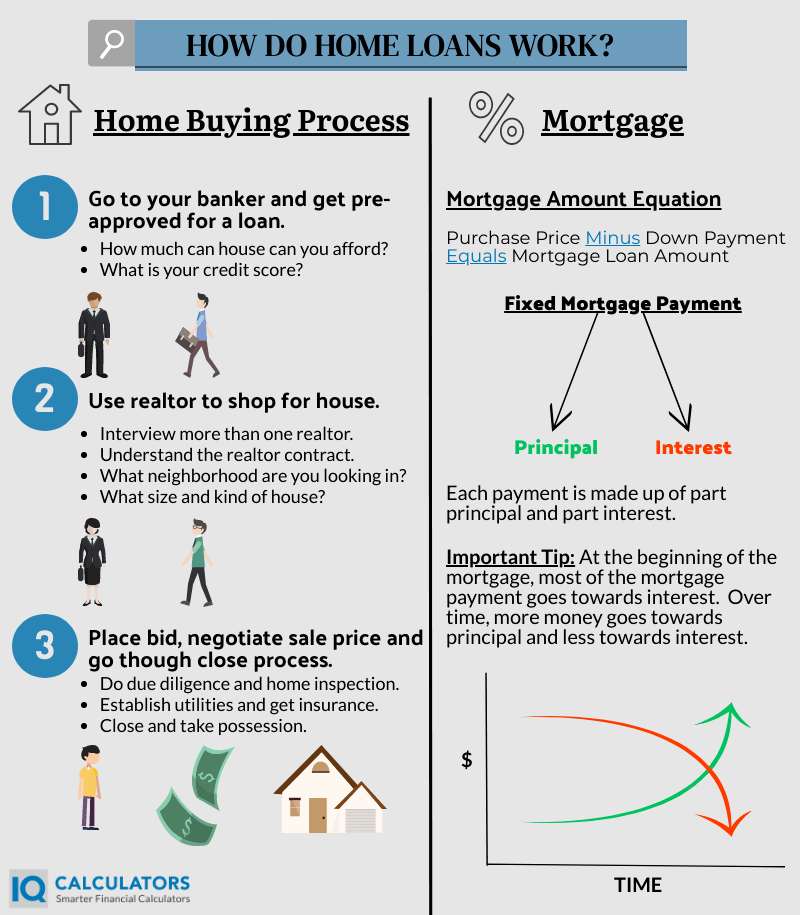

This mortgage pre-approval calculator gives you the opportunity to know in advance how much home financing you can qualify for. FHA loan limits were established to define how much you can borrow for a HUD-backed mortgage. Our affordable lending options including FHA loans and VA loans help make homeownership possible.

A pre-approval does not constitute a loan commitment or guarantee of a loan. The terms electronic mortgage electronic mortgage loan eMortgage and eMortgage loan have the same meaning. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years for.

The home you consider must be appraised by an FHA-approved appraiser. The pre-approved auto loan process can bring you. Pre-qualification can be a first step toward understanding how much car you can afford and what your payments and interest rate may be but it does not include the critical steps of having your credit report and other financial information reviewed which is part of the pre-approval process.

There are certain requirements borrowers must meet to qualify for an FHA loan including. Theyll face the same credit and financial scrutiny as a spouse. Down Payment Grants for FHA Loans.

To get a rate quote or to start the approval process fill out our Request A Quote form below or call us at 8006275263. When considering buying a home you may choose to get pre-qualified for a mortgage to estimate how much you qualify to borrow before beginning the mortgage application or pre-approval processStart by answering a few questions to tell us a little about your loan requirements and the home you want to buy. A VA loan is an important benefit earned by our military.

Final loan approval is subject to a full Underwriting review of support documentation including but not limited to applicants creditworthiness assets income information and a satisfactory appraisal. You can only get a new FHA loan if the home you consider will be your primary residence which means that it cant be an investment property or second home. Since interest rates fluctuate frequently things can change between the day you apply for your loan and the day you close.

Ownership interest in a property. Arguably the most important number to have in your head before using our home affordability calculator is your desired monthly payment. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice.

You must occupy the property within. Another veteran who has VA loan entitlement can be a co-borrower as long as this person will live in the home with you as his or her primary residence. VA approval is required for this type of setup unless the veteran happens to be your spouse.

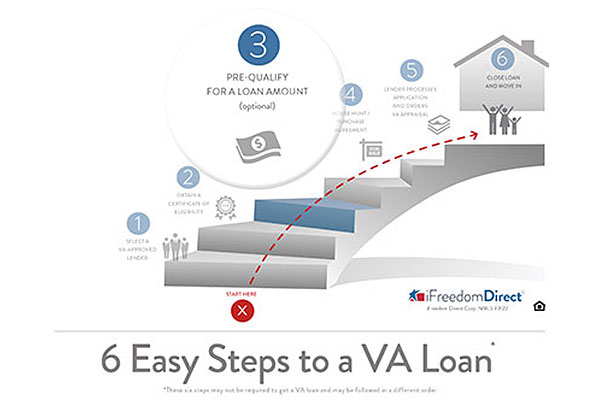

To start select an eligible VA loan lender apply for a Certificate of Eligibility COE apply for pre-approval and shop the housing market. The VA loan is a zero-down mortgage program that helps service members veterans and their eligible spouses buy or refinance a home. For any mortgage to close youll need to provide the right documentation to your lender and have that.

Figure out your desired monthly payment. After signing a purchase agreement with the seller you can submit your application and the lender will order an. You can also give us a call at 833 326-6018.

How to get pre-qualified for a home loan. AOPAs aircraft loan calculator allows you to calculate your monthly aircraft loan payments using various terms rates. If you feel like youre ready apply for a VA loan with Rocket Mortgage today.

Bonds securitizing mortgages are usually. Likewise if you exceed the 60 to 90 day time-frame it will no longer be valid. Biltmore Lane Madison WI.

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Majority of sellers also request for a pre-approval letter before closing a deal. You must go through the pre-approval process all over again.

The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buy. Learn what is required so you can speed up the approval process. Texas Consumer Complaint Recovery Fund Notice.

Most homebuyers who obtain pre-approval are serious about buying a house within the said time. Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. And from applying for a loan to managing your mortgage Chase MyHome has you covered.

If you qualify you can get a great interest rate with no money down which means homeownership can be more affordable with a VA home loan. Aviation Finance Piston Aircraft. 25 years for a loan on a multi-wide manufactured home and lot.

Each state has different limits so be sure to look up your state to understand what is available for your FHA home loan. How the mortgage pre-approval calculator works. This is the difference between the homes market value and the outstanding balance of the mortgage loan as well as any other liens on the property.

Turbine. Pre-approval is subject to a. Even better getting conditional approval for a home loan doesnt require much extra work.

American Financial Network Inc. 15 years for a manufactured home lot loan. To get a VA loan borrowers must meet the basic VA loan requirements outlined above.

If youre serious about buying a home you need to get pre-approved for a mortgage. But please understand its a calculator only and the official number will be determined by a mortgage lender. A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages.

Sustainable Home Ideas Apr 14 2022. Visit our mortgage education center for helpful tips and information.

Va Mortgage Calculator Calculate Va Loan Payments

/mortgage-preapproval-4776405_final2-f5fbd4d3d08d4aeeb04cc12fc718ae00.png)

How To Get Pre Approved For A Mortgage

Can I Afford To Buy A Home Mortgage Affordability Calculator

Step By Step To A Va Loan 3 Prequalifying Military Com

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

Downloadable Free Mortgage Calculator Tool

Home Loan Calculator Home Mortgage Calculator

Mortgage Pre Approval Calculator

Va Loan Calculator

Va Loan Calculator Check Your Va Home Loan Eligibility

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Millions Of Veterans Have Already Used This Benefit See What The Va Loan Can Do For You Mortgage Loans Va Loan Refinance Mortgage

Va Loan For A Second Home How It Works Lendingtree

Downloadable Free Mortgage Calculator Tool

Va Loan Calculator Check Your Va Home Loan Eligibility

Va Loan Affordability Calculator How Much Home Can I Afford

Va Loan Funding Fee Closing Cost Calculator